Equity Part 3 - Index Fund Past Performance

I would like to speak about 5 Index funds

- Nifty 50 Index fund

- Nifty Next 50 Index fund

- Nifty 100 Index fund

- S&P 500 Index fund

- NASDAQ Index fund

Nifty 50:

If you want to invest in the most valued company in Indian NSE, then Nifty 50 has those companies for you! So the risk/return will be less compared to other index funds.

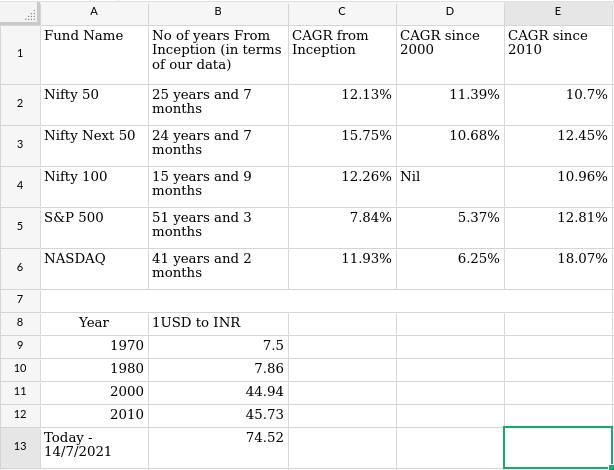

The index value was 848 on 1/1/1996 and 15,854 on 1/7/2021, so the CAGR (Yearly interest) seems to be around 12.13%. Similarly, the index was at 1546 on 1/1/2000, which yields a CAGR of 11.39% in the last 21 years. Similarly, the index was at 4882 on 1/1/2010, which gives a CAGR of 10.70% in the previous 11 years.

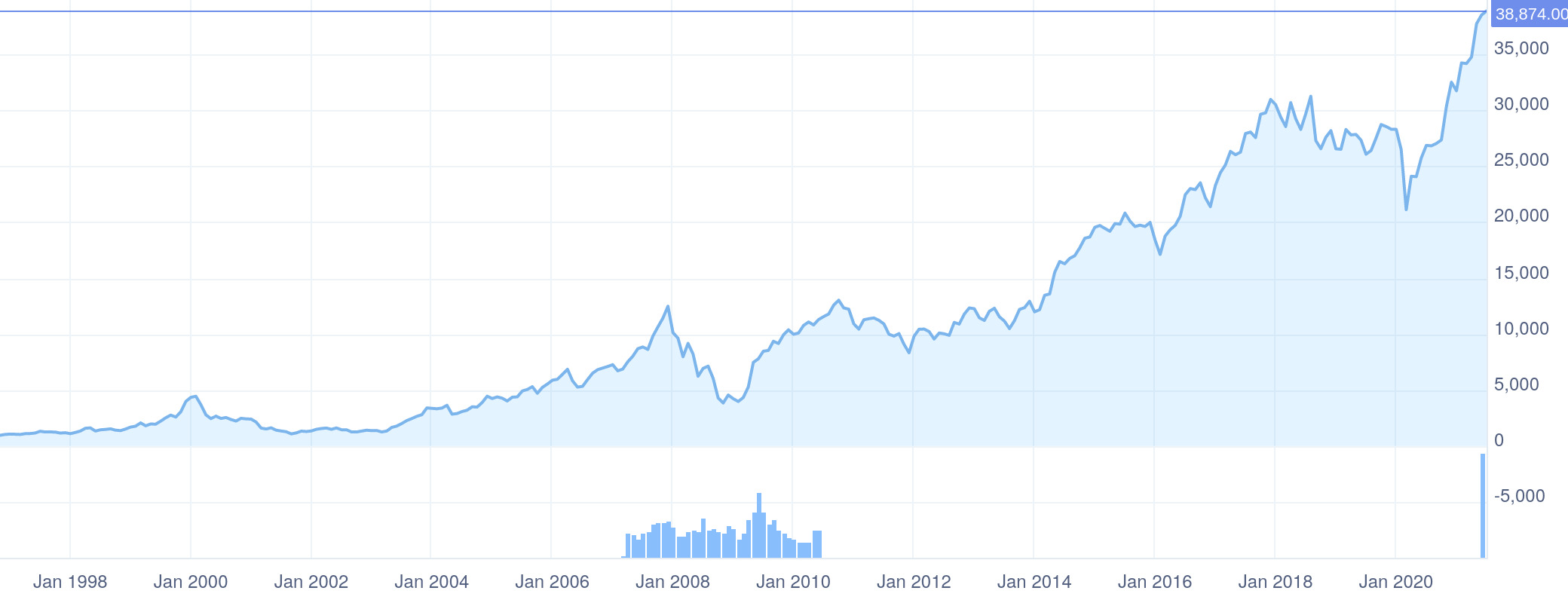

Nifty Next 50:

I like to look at the Nifty 50 as a set of companies like well-developed companies, but Nifty Next 50 are like a set of companies are fighting to reach that state. So their risk/return will be slightly higher than Nifty 50.

This index value was 1068 on 1/1/1997, and its value is 38,874 on 1/7/2021, so the CAGR (Yearly interest) seems to be around 15.75%. Similarly, the index was at 4352 on 1/1/2000, which yields a CAGR of 10.68% in the last 21 years. Similarly, the index was at 9985 on 1/1/2010, which gives a CAGR of 12.45% in the previous 11 years.

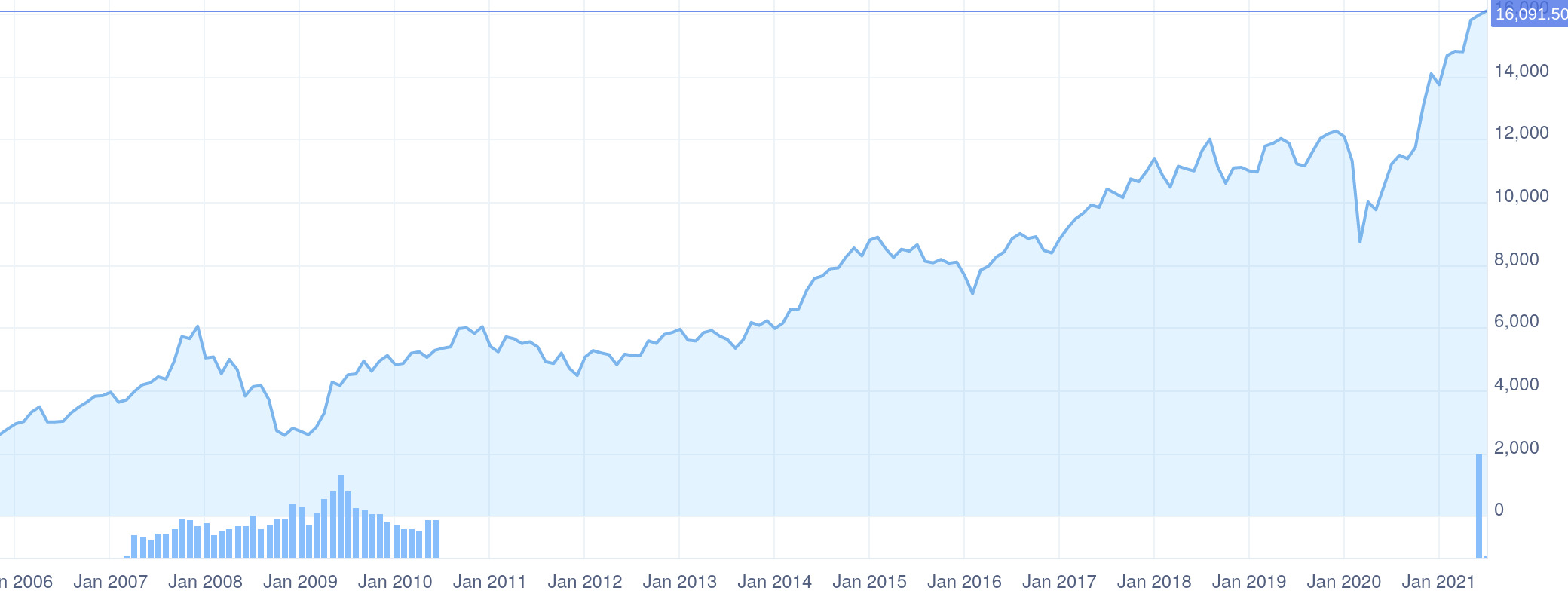

Nifty 100:

Even though it encloses the companies from both Nifty 50 and Nifty Next 50 together, it is not an alternative to putting your investment in those two funds individually. For this, we have to understand how our money is getting invested across various companies in a given index fund. Let’s talk about Nifty 50 first, the invested amount will be distributed across these 50 companies, the weightage with which each it is getting distributed depends on the valuation of the companies in that list. For example, say the first company dominates Nifty 50, say around 40% of the valuation comes from this company, then 40% of the investment will go to this company. Similarly, all the companies will get their share depending on their evaluation.

In the real world, there will be some N companies dominating Nifty 50, and M companies will be dominating Nifty Next 50. But when it comes to Nifty 100, these N companies from Nifty 50 will not only dominate the remaining Nifty 50 companies but also all the companies from Nifty Next 50.

Hence Nifty 100 becomes more resistant to fluctuation. Meaning it is less risky & less in returns than splitting the investment amount equally across Nifty 50 and Nifty Next 50. This index value was 2605 on 1/11/2005 and, its value was at 16,091 on 1/7/2021, so the CAGR (Yearly interest) seems to be around 12.26%. Similarly, the index was at 4,822 on 1/1/2010, which yields a CAGR of 10.96% in the last 11 years.

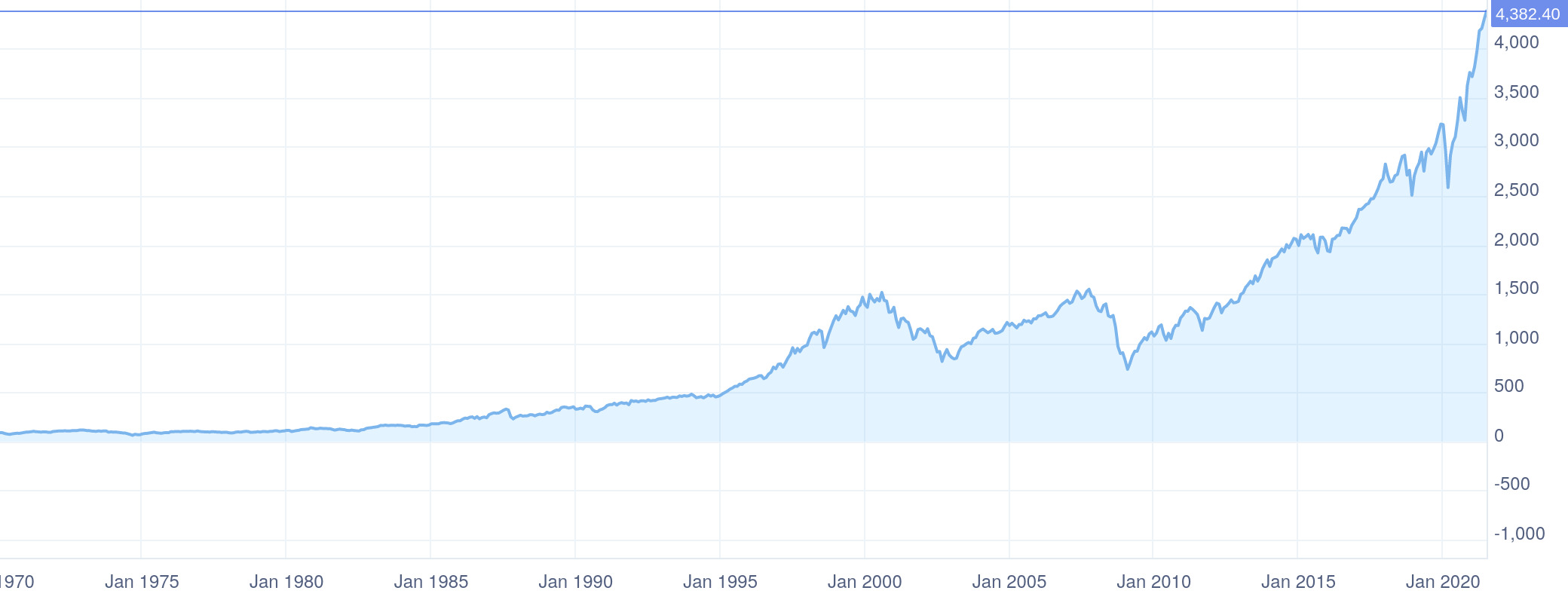

S&P 500:

It is the first index fund start across the world. It was started in America by John C. Bogle with his mutual fund company called The Vanguard Group. Creating a fund with a minimum expense ratio (broker fee) is what he wanted.

If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be John Bogle

- Warren Buffett

This Index fund has top-500 companies from the American stock exchange. You can take a look at its return by year. Since it has top 500 companies it is very stable. There are Mutual fund companies like Motilal Oswal who help to invest in these funds. The harder to predict thing for us is the Dollar to Rupee conversion rate. Even if you get a good return because of the currency conversion rate, you might lose money. I don't clearly understand how this works and how taxation works in this case. If and when I find this, I will update it here!

This index value was 89.63 on 1/3/1970 and, its value was at 4,297.5 on 1/6/2021, so the CAGR (Yearly interest) seems to be around 7.84%. During 1970, seems like the dollar to rupee conversion ratio is 7.5, but as of 14/7/2021, this conversion ratio is 74.52. So we would have got a good return because of this also.

Similarly, the index was at 1394.5 on 1/1/2000, which yields a CAGR of 5.37% in the last 21 years. The dollar to Rupee conversion ratio is 44.94 in the year 2000.

Similarly, the index was at 1074 on 1/1/2010, which yields a CAGR of 12.81% in the last 11 years. The dollar to Rupee conversion ratio is 45.73 in the year 2010.

NASDAQ

NASDAQ is also based on the American Stock market. So it will have similar cautions/positives that I previously stated for S&P-500. It uses a market capitalization weighting methodology. So it mostly will have top-performing companies, so the risk/return is high in this case. As of March 2020, it’s dominated by the Technology sector that has 48% and Consumer services has 20% and Health care has 10% and, the remaining is distributed across much more categories.

This index value was 140 on 1/4/1980 and, its value was at 14,504 on 1/6/2021, so the CAGR (Yearly interest) seems to be around 11.93% (1USD to INR in 1980 is 7.86). Similarly, the index was at 3940 on 1/1/2000, which yields a CAGR of 6.25% in the last 21 years. Similarly, the index was at 2147 on 1/1/2010, which gives a CAGR of 18.07% in the previous 11 years.

I have finally summarized the details about these index funds in the below image.

Note:

Always choose the Direct plan option when you invest in a mutual fund because regular means someone from the house is helping you. So you will pay more expense ratio, which means less return for us. So never choose “Regular” always “Direct” as your plan type.

Also, always choose “Growth” (even over “dividend reinvestment”) instead of “dividend payout” so that the interest amount is again invested and you get the compounding effect. In case if you want to take out the dividend, then go for the dividend payout approach.

Whatever I have stated here is my understanding, my blogs intend to be an ice breaker and not make someone expert by just reading this blog. Please validate the content posted here on your terms. Please don’t make any decisions by just reading this post alone.

I sincerely like to thank three people who help to gain this knowledge over the last 6-9 months.

- Vijay Mohan - https://www.youtube.com/InvestmentInsights/

- Anand Srinivasan - https://www.youtube.com/MoneyPechu/

- Karthik k - a colleague of mine

- Also, I would recommend having a look at Zerodha personal finance blog

References:

- I learned a lot from the Vijay Mohan channel and Anand Srinivasan channel.

- Performance of BSE Index fund from this video and its description

- Google images for the compound effect images & compound interest formula image.

- Historical USD to INR conversions is based on this post

- Grow.in for a sip and lump sum calculator

- in.investing.com for the index fund historical charts