Equity Part 2 - Basis of Index Fund

Impact of compounding effect

Before understanding which of these is a better place to start, let us form a consensus on the basics of self-finance!

Everyone one of us likes to have a good amount of wealth. So for this, we need money. But working on your own to become rich is not possible in this current world. You will need many others to work for you. These workers can be of two types,

- Fellow humans

- Money

Earning money with the help of money is the simplest but best way of dealing with things. Money always goes to people who have more money. (I am saying this in a world where capitalistic views are dominant. It doesn’t matter if we like it or not. But this is how things happen in today’s world).

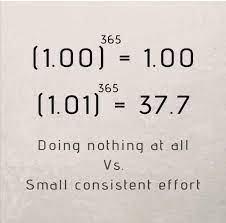

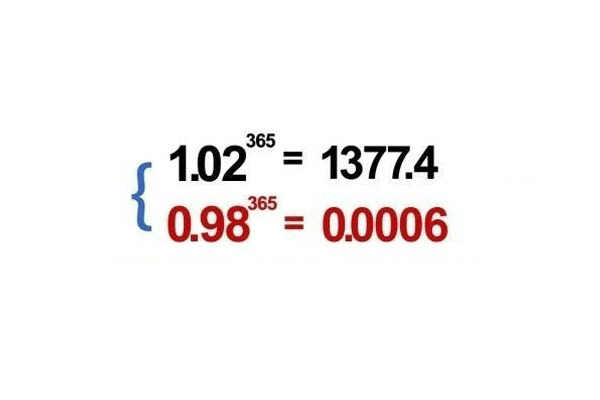

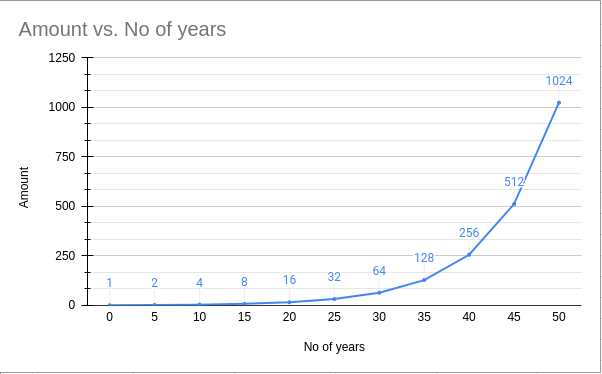

Since we are starting to speak about growth, we can’t avoid the topic of the Compounding effect. Einstein calls this the 8th wonder of the world. The Compounding Effect is about putting in small changes every day, which will give an immense result in a long time! Usually, there will be a point before which we will not get great results, but beyond that point, results will go sky-high. This point is called the Tipping point. So we have to wait till we cross the tipping point to see great results. It applies to finance, building knowledge, becoming good at arts/sports, etc. The below images show the compounding effect in terms of numbers.

So we must put in our money where it can safely get compounded.

How compounding works

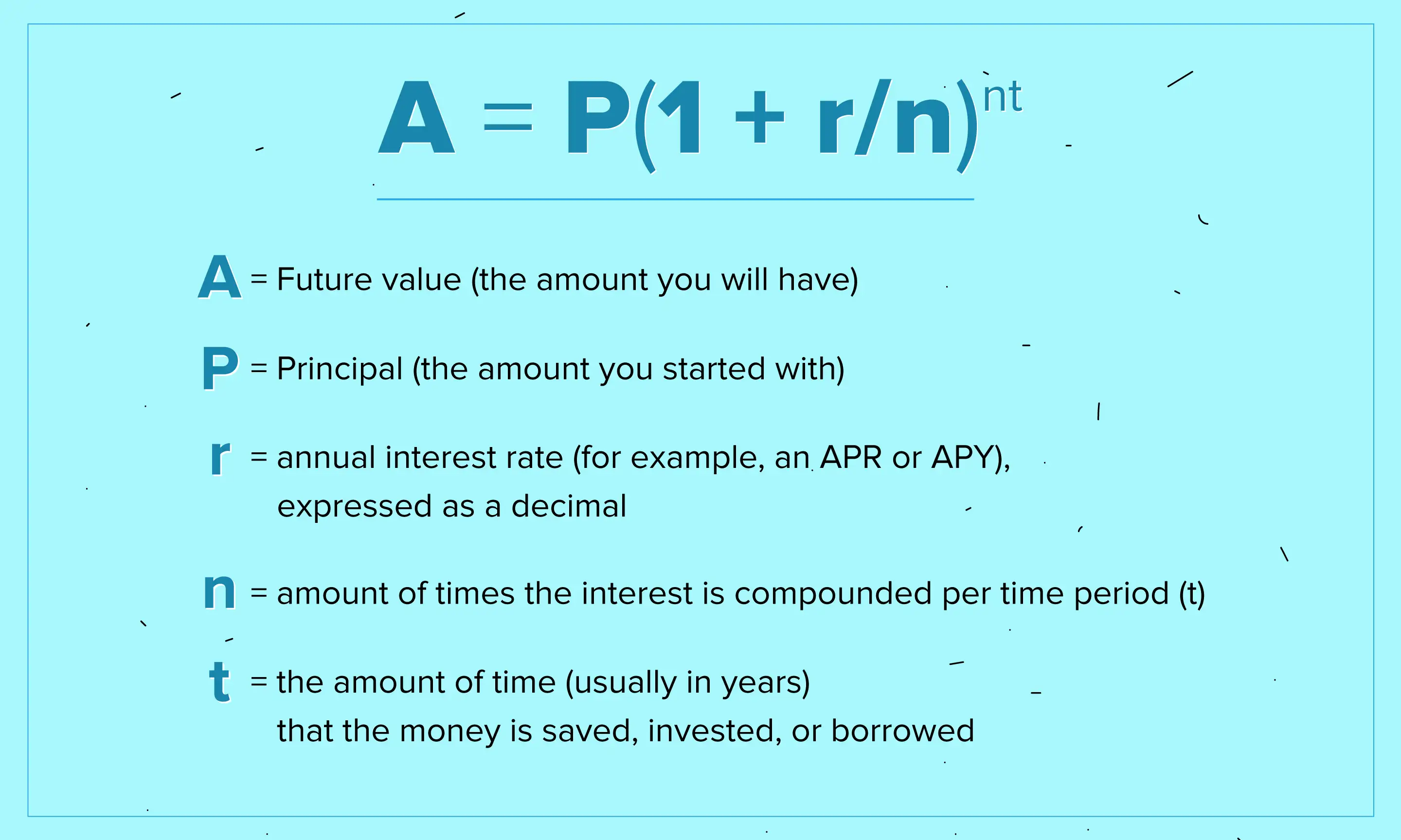

Now let’s look at the compounding interest formula.

There are two things here to get a better compounding effect.

- No of years for which we invest (t)

- Rate at which we get interest (r)

The principal amount here doesn’t speed up the compounding effect. It just increases the scale. Hence, we can go two ways from here:

- If you go after a higher Rate of interest, then with a small investment time. Thus you will get a large amount. But the risk is high in this case! Because the rate of interest is high, it will be hard for the borrower to repay.

- If you go after a longer investment time, then with a small Rate of interest. Thus you will get a large amount. But the risk is low in this case! Because the rate of interest is low, it will be easy for the borrower to repay.

To be rich is not enough that your principal earns an interest amount. Your first-level interest amount also must bring about a second-level interest amount. Still, that is not good enough. Your second-level interest amount also must bring about a third-level interest amount. Still, that is not good enough. Your third-level interest amount also must bring about a fourth-level interest amount. Still, that is not good enough. Your fourth-level interest also must bring about a fifth-level interest amount. The more levels you go to, the easier you become rich! It is like a tree the deeper it gets, the better it is for us.

So it is a marathon instead of a short sprint. It is about sustaining for a long time, without falling. So I want to choose an option where we can have almost guarantee returns to be good in the long term. Hence I want to stick with a less risky fund like an index fund.

How good is an index fund?

Let us take the answer from Warren Buffett,

By periodically investing in an index fund, the know-nothing investors can outperform most investment professionals.

He proved this by making a bet against a mutual fund manager. Warren Buffett will invest only in S&P-500 (American index fund) and the mutual fund manager will manage a portfolio actively. The period for this is ten years. Warren Buffett won this bet.

The problem here is there will be a situation where you will have a fund that performs better than our Index fund, but this will last only for 5-8 years max. Anand Srinivasan says, only 10-20% of the fund will beat index funds in a given year. i.e., 0.2 is the maximum chance of getting a fund right! But you have to take money out when it starts to go bad (5-8 years max). Also, when you take your money out, you will be paying tax which plays against your growth. To pick two successful funds continuously, your chances are 0.2 * 0.2, which results in 0.04, which is a 4% chance. To pick three successful funds continuously, your chances are 0.2 * 0.2 * 0.2, which results in 0.008, which is a 0.8% chance. Note you don’t even have a 1% chance of getting three successful funds continuously! with this short period, we can’t expect the compound effect to make us rich!

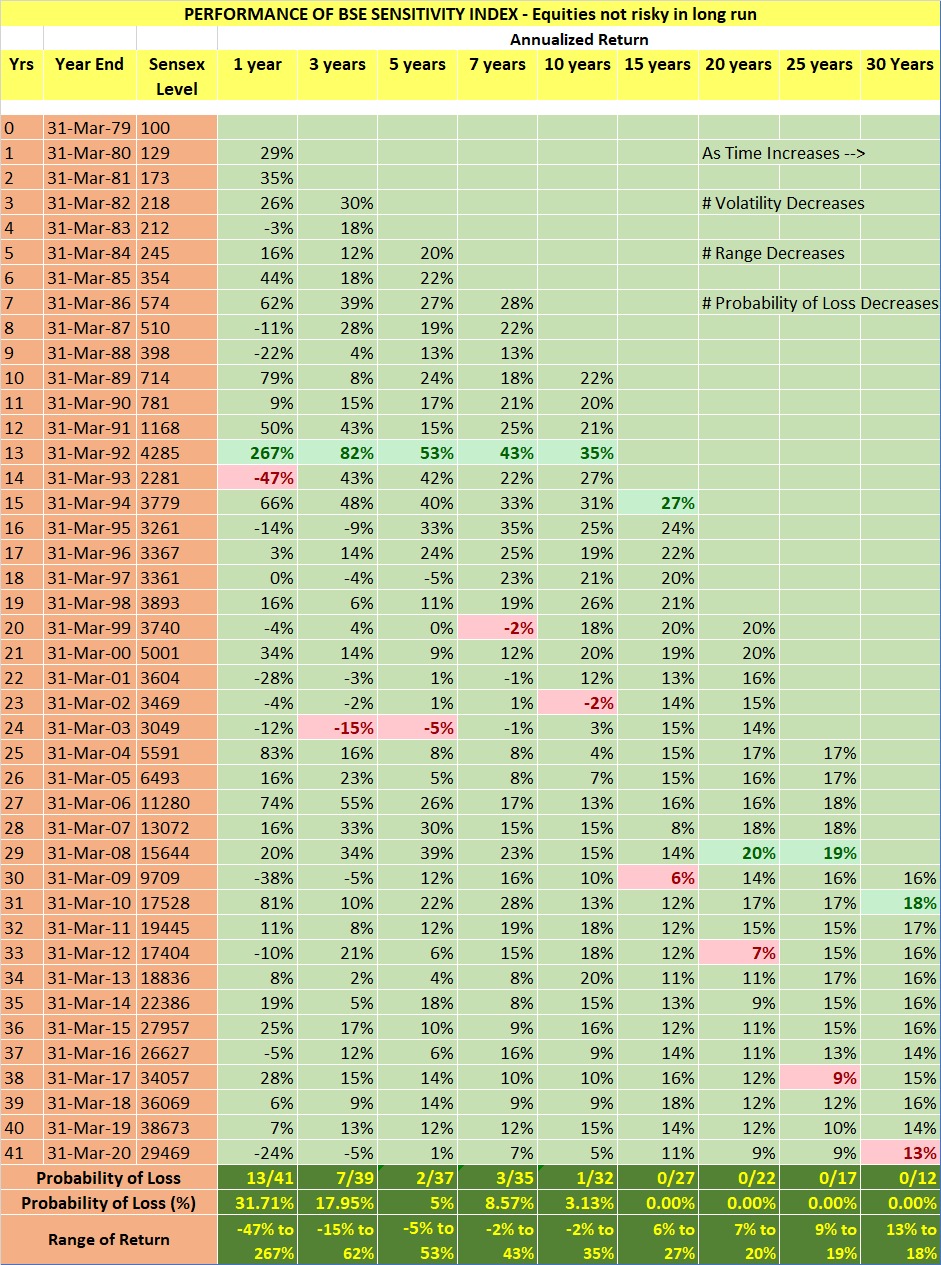

Now let’s see the returns for the BSE index fund in the past 45 years. Each column ranging from 1-30 years means if you invest in an index fund for that long, how much percentage you will get in returns. Look at the last row when the no of invested period grows, the range of return becomes less oscillating, meaning much safer for us. Hence the usual saying, The market is unpredictable in the short-term but somewhat clearly predictable in the long-term. Also, the probability of loss percentage becomes zero percentage if your investment period is above 15 years. (this is the case in the past, it need not be the same for the future. But nothing wrong in having hope, I guess).

Let’s come to the 72% rule. Which states that if you divide 72 by your rate of interest, to know how much time your invested money will take to become double. So let’s assume we will invest for 30 years, so now the range of returns might be between 13% to 18%. So let’s consider the average return as 15% year-on-year. That means 72/15=4.8. It means, for every four years and ten months our money becomes double. Let’s round off this period as Five years. So if we are investing for a substantial period like 30 years, we can expect a doubling effect once Five years.

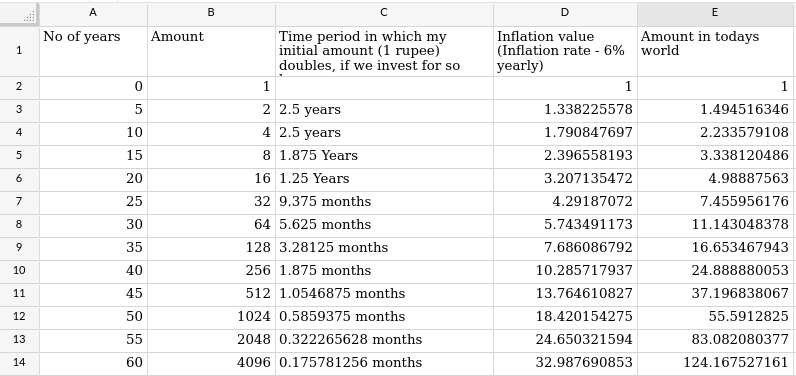

Let me explain this table. In the above setting, we found if we invest for 30 years or more on average, we can expect a 15% year-on-year interest rate. With that, we found every five years amount will get doubled. So The first column has rows incremented in terms of 5 years. In the amount column, the amount becomes double for each row above it. Let’s say we stick for the no of years that we have specified in that row. Then the third column says, with how much time our initial amount become double. The Inflation value column shows how much a rupee will be due to inflation for that specific amount of time from today. The last column will show how much the amount column value is worth in today’s world. I have used 6% as the average inflation rate.

It is also clear that 25 years is the tipping point for this table/image. Because for the first time, the Amount (y-axis value) goes above No of years (x-axis value). Also, beyond that point, the return goes skyrocketing. It is about sticking with the index fund for such a long time. So I plan to invest for ten years every month and let it grow for another 20-30 years. I believe this to be a good basket to have in our retirement planning. (we must have other baskets also)

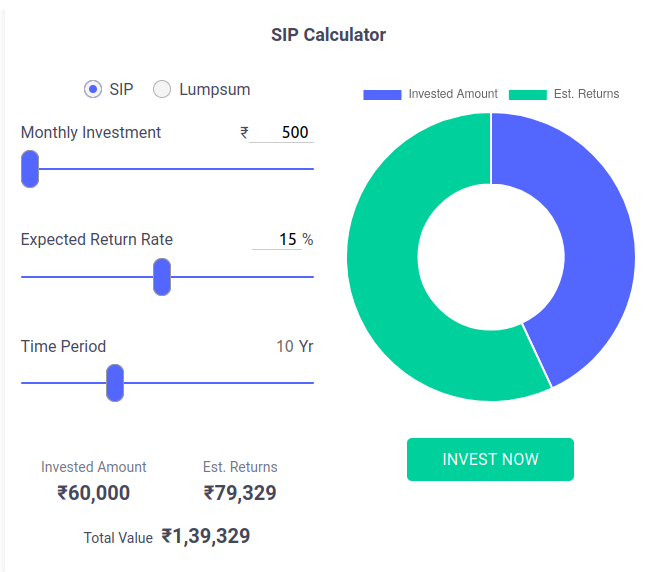

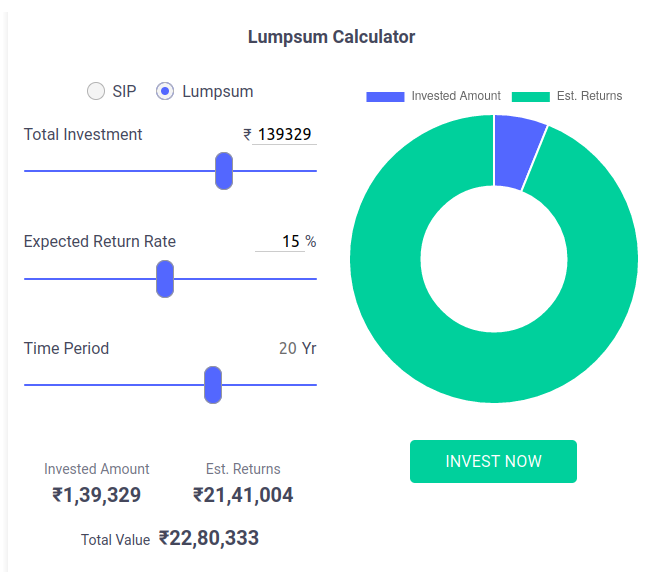

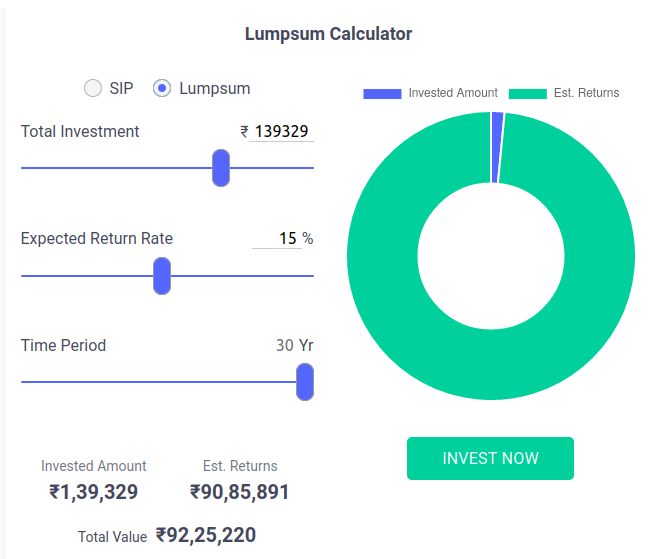

I have attached sample investment amounts for the plan I have stated. Let’s assume we invest Rs 500 for 120 months for every month. Then I will have 1,39,329 (77,800 in today’s value). Then I leave to compound silently for the next 20 year period. I will have 22,80,333 (3,97,030 in today’s value). But instead, I choose another ten years (30 years after completing the initial ten years of monthly investment). Then I will have 92,25,220 (8,96,896 in today’s value). Remember actual investment was for just 60,000 rupees. Remember, these values are calculated under the assumption you are ready to wait for 30 years. Time is the key point.

Thus an Index fund is a very stable and solid option if you would like to have good planning for your retirement. Let’s assume you choose to get married and let’s assume you choose to have a child. If you can invest 1 Lakh in today’s index fund, it will get compound to 10 Crores when they are 50 years old and 40 crores when they are 60 years old. I am saying this because many of us save a lot for the next generation. It is better to use time in your favor. Nothing can beat time and the compound effect. So that your child need not worry about their retirement savings. They can choose to live their life without the burden of retirement savings.

Another important thing is knowing when to liquidate the fund. It is better to have a Five year time period to liquidate the fund. I don’t think we can choose a random day to liquidate the fund and think we will have the best returns. The recession seems to be happening once every ten years if we check the last 30 years’ data. So if you happened to pick the wrong time where a recession is ongoing, it is not advisable to get your money out. So if we have five years time period to choose from, then we can choose a time when the market is high depending on when was the last recession and how the market is performing now.

Also, this is why it’s tough for us to get into the brackets of people who have been rich for generations because we will be fighting against 100 years+ of compounding effects.